Business Insurance in and around Pittsburgh

One of the top small business insurance companies in Pittsburgh, and beyond.

No funny business here

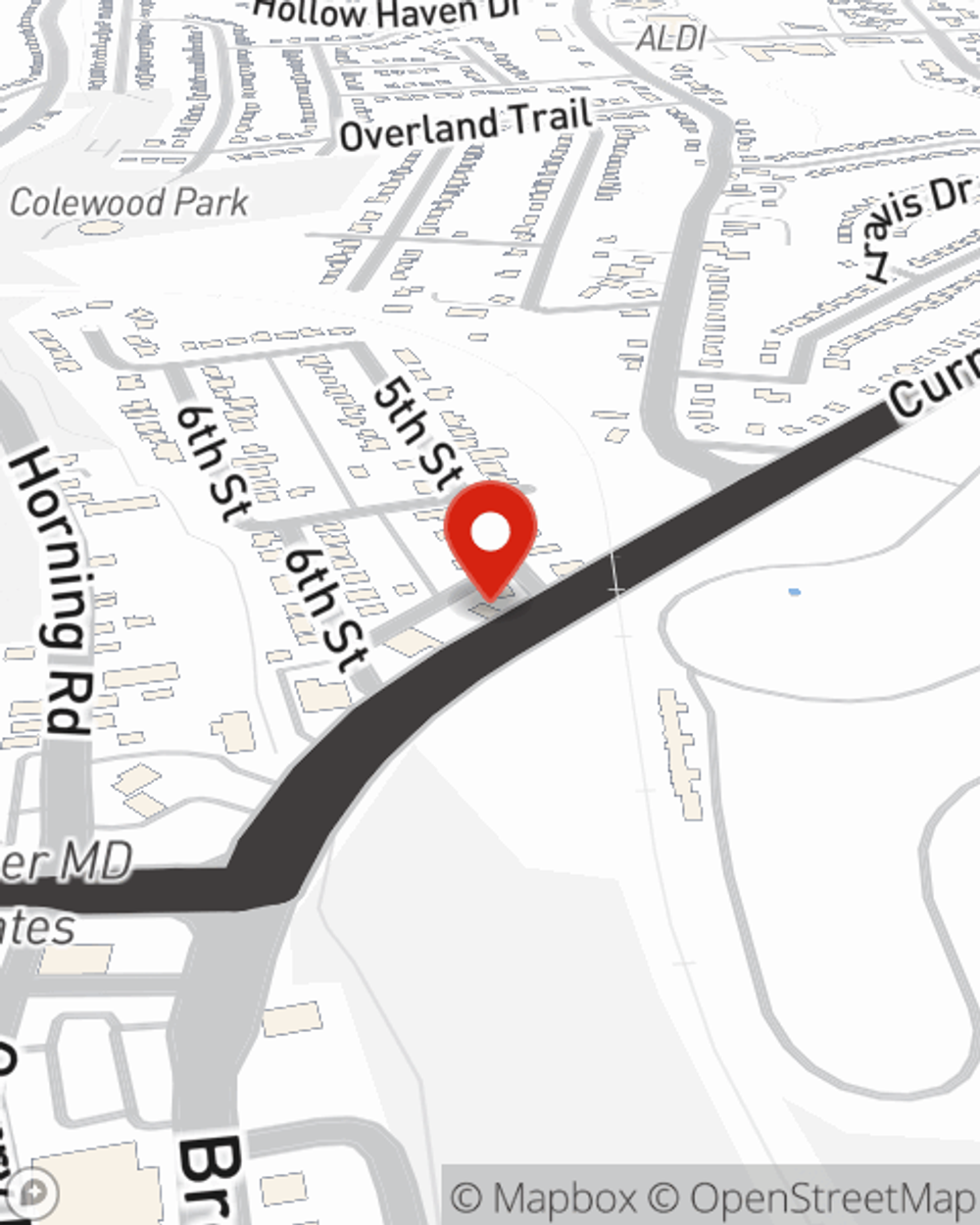

- Pittsburgh

- Baldwin

- Whitehall

- South Park

- Pleasant hills

- Jefferson Hills

- Castle Shannon

- West Mifflin

- Bethel Park

- Upper St Clair

- Clairton

- Mt Lebanon

- Brentwood

- Finleyville

Coverage With State Farm Can Help Your Small Business.

You may be feeling overwhelmed with running your small business and that you have to handle it all alone. State Farm agent Chad Clark, a fellow business owner, understands the responsibility on your shoulders and is here to help you get started on a policy that's right for your needs.

One of the top small business insurance companies in Pittsburgh, and beyond.

No funny business here

Protect Your Future With State Farm

If you're looking for a business policy that can help cover loss of income, business liability, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

At State Farm agent Chad Clark's office, it's our business to help insure yours. Contact our excellent team to get started today!

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Chad Clark

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.